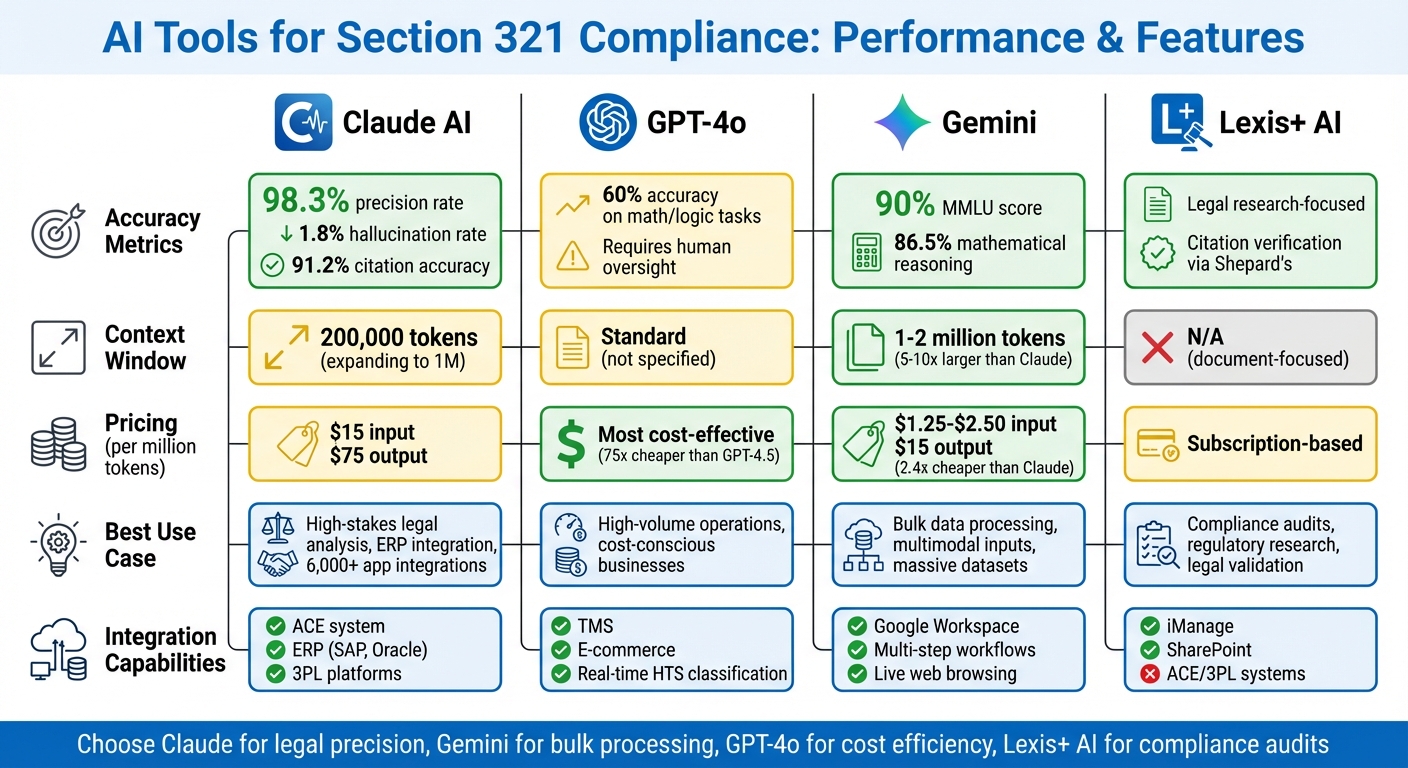

Section 321 compliance is critical for businesses importing low-value shipments into the U.S. Without proper adherence, companies risk penalties, shipment delays, or confiscation by U.S. Customs and Border Protection (CBP). Automated tools like Claude AI, GPT-4o, Gemini, and Lexis+ AI simplify this process by streamlining data extraction, customs filings, and compliance checks.

Key takeaways:

- Claude AI excels in accuracy (98.3%) and handles large data sets with its 200,000-token context. It integrates with ERP systems and automates customs workflows efficiently.

- GPT-4o offers affordability and solid performance for high-volume operations but requires human oversight to avoid errors.

- Gemini supports massive datasets (up to 2 million tokens) and multimodal inputs, making it ideal for processing extensive shipping logs.

- Lexis+ AI specializes in legal validation and compliance audits, but it’s less suited for real-time shipment processing.

Each tool has strengths tailored to specific tasks. For detailed legal analysis, Claude AI is a top choice. For bulk data processing, Gemini is more cost-effective. Combining tools can maximize efficiency and reduce compliance risks.

AI Tools for Section 321 Compliance: Feature Comparison Chart

1. Claude AI

Claude AI has set a new benchmark for accuracy in Section 321 filings, achieving an impressive 98.3% precision rate, the best among major language models as of 2025. This level of accuracy is critical when dealing with large volumes of low-value shipments, where even minor mistakes can lead to costly CBP penalties or delays.

Accuracy in Section 321 Filings

With a low 1.8% hallucination rate and three times fewer reported hallucination complaints, Claude significantly minimizes customs filing errors. For instance, it reduces instances of missing or incorrect data in Type 86 forms. Additionally, Claude correctly attributed sources in 91.2% of responses requiring citations as of Q2 2025, ensuring dependable references for HTS codes and regulatory documents.

Handling Low-Value Shipment Data

Claude’s ability to process vast amounts of data is powered by its 200,000-token context window, enabling it to handle large batches of shipment manifests, commercial invoices, and packing lists in a single prompt. Its multimodal vision capabilities allow it to extract data from photos of shipping labels, invoices, and even handwritten notes, eliminating the need for manual data entry. Future updates aim to expand its capacity to support up to 1 million tokens, further enhancing its ability to manage complex data extraction tasks for automated customs processing.

Customs Compliance Automation

Claude’s strengths in accuracy and data processing extend to broader customs automation. Built on a "Constitutional AI" framework, it ensures ethical and transparent interactions that align with international trade standards. By 2025, Claude had passed 9 out of 10 international AI safety audits, including ISO/IEC 42001. Its tool use capabilities enable seamless interaction with external systems via API, automatically formatting shipment data for submission to the Automated Commercial Environment (ACE) or generating structured JSON outputs for customs workflows.

Integration with 3PL Systems

Claude integrates seamlessly with over 6,000 enterprise software applications, including ERP platforms like SAP and Oracle ERP Cloud, which are widely used in 3PL operations. Its API handles an average of 820 million requests daily, demonstrating its ability to manage high volumes. In finance and compliance, 24% of teams rely on Claude for tasks like policy summarization and risk analysis – essential for staying compliant with Section 321 de minimis rules. Additionally, the API is 20% more cost-efficient for long-form parsing, making it a practical choice for businesses managing thousands of shipments daily while reducing compliance risks across the supply chain.

2. GPT-4o

GPT-4o is OpenAI‘s cost-effective solution for automating Section 321 compliance. It’s particularly well-suited for businesses handling large volumes of low-value shipments. With GPT-4.5 costing 75 times more, GPT-4o stands out as the practical option when compared to other models for high-volume third-party logistics (3PL) operations, offering a balance of affordability and functionality.

Accuracy in Section 321 Filings

When it comes to structured data tasks, both GPT-4o and GPT-4.5 perform well. GPT-4.5 achieves around 60% accuracy on math and logic challenges, surpassing Claude 3.7 Sonnet, which scores 46%. This makes GPT-4.5 highly effective for processing numerical data and handling classification tasks like Type 86 forms and HTS code assignments. However, GPT-4o’s simplified approach to transcripts can sometimes miss critical nuances, potentially leading to data errors. Kristen Schmidt from RIA Oasis warns that relying on unchecked AI outputs could result in inaccurate compliance records.

Handling Low-Value Shipment Data

GPT-4o is adept at transforming unstructured inputs – such as text, voice, and video – into structured, actionable data, all without the need for human intervention. It automates tasks like data entry for Type 86 filings and even analyzes historical trade data to identify potential compliance risks. That said, human oversight remains crucial. Since businesses are legally accountable for all CBP submissions, they must ensure that AI-generated outputs are carefully reviewed to avoid errors.

Integration with 3PL Systems

GPT-4o offers seamless integration with modern trade compliance platforms, thanks to its API-first architecture. This allows it to perform real-time HTS classification and synchronize data bi-directionally with ERP, TMS, and e-commerce systems. In 2024, 40% of enterprise software firms prioritized embedded AI features. GPT-powered HTS classification tools claim accuracy rates as high as 99%, based on CBP rulings. For businesses navigating Section 321 compliance, GPT-4o acts as a command hub, automating follow-ups and improving efficiency across the supply chain.

3. Gemini

While Claude AI and GPT-4o focus on precision and cost-conscious solutions, Gemini sets itself apart with its ability to process vast amounts of data and handle multimodal inputs. Google’s Gemini prioritizes these capabilities, making it particularly effective for tasks like Section 321 compliance. Its impressive context window – ranging from 1 to 2 million tokens – is about 5 to 10 times larger than Claude’s 200,000-token limit. This means Gemini can handle massive datasets, such as years of shipping logs or extensive SKU catalogs, in a single session.

Accuracy in Section 321 Filings

In terms of accuracy, Gemini 3 achieved a 90% score on the MMLU benchmark, which evaluates knowledge across 57 subjects, including business law and statistics. While this demonstrates considerable breadth, it doesn’t necessarily translate to dominance in logic-heavy tasks like customs filings. For mathematical reasoning, Gemini 1.5 Pro scored 86.5%, slightly outperforming Claude 3.7 Sonnet’s 82.2%. However, when it comes to complex legal reasoning – like interpreting detailed CBP rulings – Claude often delivers more consistent results over multi-step workflows.

Handling Low-Value Shipment Data

Gemini 2.5 Pro shines in its ability to work with diverse data types. Unlike text-only models, it can natively analyze physical shipping documents, labels, invoices, and even X-ray images. This capability aligns with CBP’s growing emphasis on visual commodity detection. Gemini’s automated data extraction reduces the need for manual transcription and achieves over 85% first-contact resolution for technical issues.

Integration with 3PL Systems

Gemini Agent integrates seamlessly with Google Workspace tools like Gmail, Drive, and Calendar, simplifying customs documentation and automating filing schedules. It can autonomously execute multi-step workflows, such as researching current HTS codes through live web browsing and drafting compliance reports based on real-time CBP policy updates. In scalability tests with 20 concurrent users, Gemini’s response time increased by only 2 seconds, compared to Claude’s 5-second delay. Additionally, Gemini is cost-effective for high-volume operations, charging $1.25 per million input tokens – about 2.4 times less than Claude 3.7 Sonnet’s $3.00 rate. This combination of affordability and integration makes Gemini a strong contender for managing automated compliance workflows.

sbb-itb-f73ecc6

4. Lexis+ AI

Lexis+ AI takes a legal research-first approach, grounding its responses in the extensive LexisNexis repository. This ensures that HTS code classifications and CBP rulings are always based on verified and reliable sources.

Accuracy in Section 321 Filings

With Shepard’s Citation Service integrated into a "Guided Research" workflow, Lexis+ AI automatically validates legal references, reducing the risk of errors in complex compliance tasks. This is especially important in customs compliance, where citing outdated or overturned CBP rulings can lead to audits. Unlike general AI models, which lack citation verification, Lexis+ AI ensures the use of up-to-date legal references.

Customs Compliance Automation

When it comes to document analysis, Lexis+ AI is designed to spot missing clauses, contradictions, and inconsistencies in large volumes of Section 321 data. Reports indicate a 284% ROI over three years for corporate legal departments and a 344% ROI for large law firms. The tool also allows users to compare regulations across jurisdictions with a single prompt and scan administrative codes for relevance. This is particularly helpful for navigating state-specific product restrictions that could impact de minimis eligibility. By focusing on legal validation, Lexis+ AI stands apart from tools that emphasize real-time operational automation.

Integration with 3PL Systems

While Lexis+ AI shines in legal research and regulatory analysis, its integration with logistics systems is more limited. It connects with document management platforms like iManage and SharePoint but does not directly integrate with CBP’s ACE system or 3PL shipping platforms. Since the platform is built for legal research and document drafting, it’s not tailored for operational logistics. For high-volume e-commerce Section 321 automation, specialized participants in the CBP Data Pilot – such as FedEx, DHL, and technology firms like PreClear – are typically required. As a result, Lexis+ AI is better suited for compliance audits and regulatory research rather than handling real-time shipment processing.

Advantages and Disadvantages

Weighing the pros and cons of these tools is crucial for automating low-value shipment compliance effectively.

AI tools bring distinct strengths to tackling Section 321 compliance challenges. Claude 3.7 Sonnet, for instance, boasts the highest success rate – 55% – when performing complex, multi-step logistics tasks. However, it falters when identifying tasks that are unsolvable, rejecting them correctly only 17% of the time. This means Claude attempts unsolvable tasks three times more often than it avoids them. These mixed results highlight the need to carefully evaluate each tool’s strengths and weaknesses.

OpenAI’s o4-mini strikes a balance, with 51% success on solvable tasks and an impressive 90% accuracy in rejecting tasks that cannot be completed. Meanwhile, GPT-4o achieves 62% accuracy in identifying unsolvable tasks but struggles with solvable ones, managing only 38% success. Gemini 2.5 Pro Preview performs better at flagging unsolvable tasks (55%) than completing solvable ones (39%).

Instruction-following is another area where Claude 3.7 Sonnet stands out, scoring 90.8% on the IFEval benchmark for adhering to explicit formatting requirements. However, all advanced models face a shared challenge: they tend to overfit to training data, which can limit adaptability in real-world scenarios.

When it comes to integration, Claude offers automated data entry via its Computer Use mode. Gemini 1.5 Pro, on the other hand, supports a massive 2-million token context window – 10 times larger than Claude’s 200,000 tokens – making it ideal for processing large-scale shipping manifests. Lexis+ AI integrates seamlessly with document management systems like iManage and SharePoint, but it lacks direct connections to CBP’s ACE system or 3PL shipping platforms.

Conclusion

Claude 4 (Opus 4.5) stands out as a strong choice for businesses managing high-stakes Section 321 compliance tasks. Scoring 9/10 in logical reasoning and achieving 96.2% accuracy on mathematical reasoning benchmarks, it excels at decoding the intricate regulatory updates brought by Executive Order 14324 in August 2025. This capability is crucial for determining Qualified Party status and calculating duty remittance methods, which range between $80 and $200 per item.

When it comes to pricing, Claude’s API costs $15 per million input tokens and $75 per million output tokens. In comparison, Gemini 2.5 Pro is priced at $2.50 per million input tokens and $15 per million output tokens. For businesses handling thousands of shipment manifests daily, Gemini’s 2-million token context window – ten times larger than Claude’s 200,000 tokens – offers a practical advantage for bulk data entry.

Given these differences in cost and scalability, it makes sense to divide tasks strategically: use Claude for detailed legal analysis and Gemini for processing large volumes of manifests. Platforms like Fello AI (https://claude3.pro) make it easier to integrate multiple top-performing models into a single interface, accessible on Mac, iPhone, and iPad.

For handling sensitive data, enterprise or API access through providers like Amazon Bedrock or Google Cloud Vertex AI is recommended.

As Section 321 compliance becomes increasingly complex post-2025, choosing the right AI tools – or a combination of them – can make all the difference. Precision-focused tools like Claude are ideal for legal tasks, while scalable options like Gemini shine in routine processing. The right balance ensures smoother customs clearance and avoids costly delays.

FAQs

How does Claude AI enhance accuracy for Section 321 compliance?

Currently, there isn’t detailed information on how Claude AI specifically enhances accuracy for Section 321 compliance. However, AI tools like Claude are built to simplify workflows by automating repetitive tasks, minimizing human error, and processing data with speed and precision. These features could play a role in supporting compliance by enabling quicker and more dependable handling of customs documentation and regulatory requirements.

On a broader scale, platforms like Fello AI provide access to multiple advanced models, including Claude, which can be applied to tasks such as research, planning, and compliance workflows. This adaptability allows businesses to customize AI tools to better align with their unique compliance challenges.

What are the advantages of using Gemini for managing large shipment datasets in Section 321 compliance?

Currently, there’s no detailed information on how Google’s Gemini model handles large shipment datasets or supports Section 321 compliance workflows. While Gemini is often compared to other models like Claude in terms of performance and features, specifics about its scalability, token limits, or efficiency in processing shipment data remain unclear.

For Section 321 compliance tasks, it might be more practical to explore AI tools tailored for managing large datasets and automating compliance processes. For instance, Claude AI is frequently highlighted for its strengths in these areas. Another option worth exploring is Fello AI, a platform that gives access to multiple AI models, including both Claude and Gemini. This flexibility allows you to evaluate and choose the model that best fits your specific requirements.

Why is human oversight critical when using GPT-4o for customs compliance?

Human oversight plays a key role when working with GPT-4o. While this AI is highly capable, it can occasionally misread tariff codes, overlook important regulatory details, or mishandle sensitive information. Such mistakes can result in delays, fines, or even compliance violations.

Having an experienced reviewer in the loop ensures that errors are identified and corrected, safeguarding accuracy and preventing costly consequences. AI tools are incredibly useful, but they shine brightest when used as part of a team, not as a one-and-done solution.