Claude AI is transforming financial workflows, offering strong reasoning, fast task completion, and powerful integrations tailored for finance professionals. Utilizing the Claude 3 AI prompt library can further optimize these workflows. Here’s what you need to know:

- Performance Benchmarks: Claude Sonnet 4.5 scored 55.32% in financial reasoning tasks, slightly behind GPT-5.1’s 56.55%, but excelled in grounded data retrieval with 94.2% accuracy compared to GPT-5‘s 63.8%.

- Workflow Efficiency: By integrating with tools like Excel and Snowflake, Claude saved Norges Bank 213,000 hours in 2025 and helped AIG cut underwriting review times fivefold while boosting accuracy.

- Cost & Speed: Claude is faster than GPT-5 (140.86s vs. 356.63s per task) but costs more ($0.98 vs. $0.44 per session).

- Integration Strengths: Unlike competitors, Claude connects with diverse platforms and data providers, enhancing usability in regulated financial environments.

- Challenges: Struggles with multi-step consistency and regulatory tasks like Basel capital calculations. It’s also pricier than some alternatives, as seen in the Claude 3 API Pricing structure.

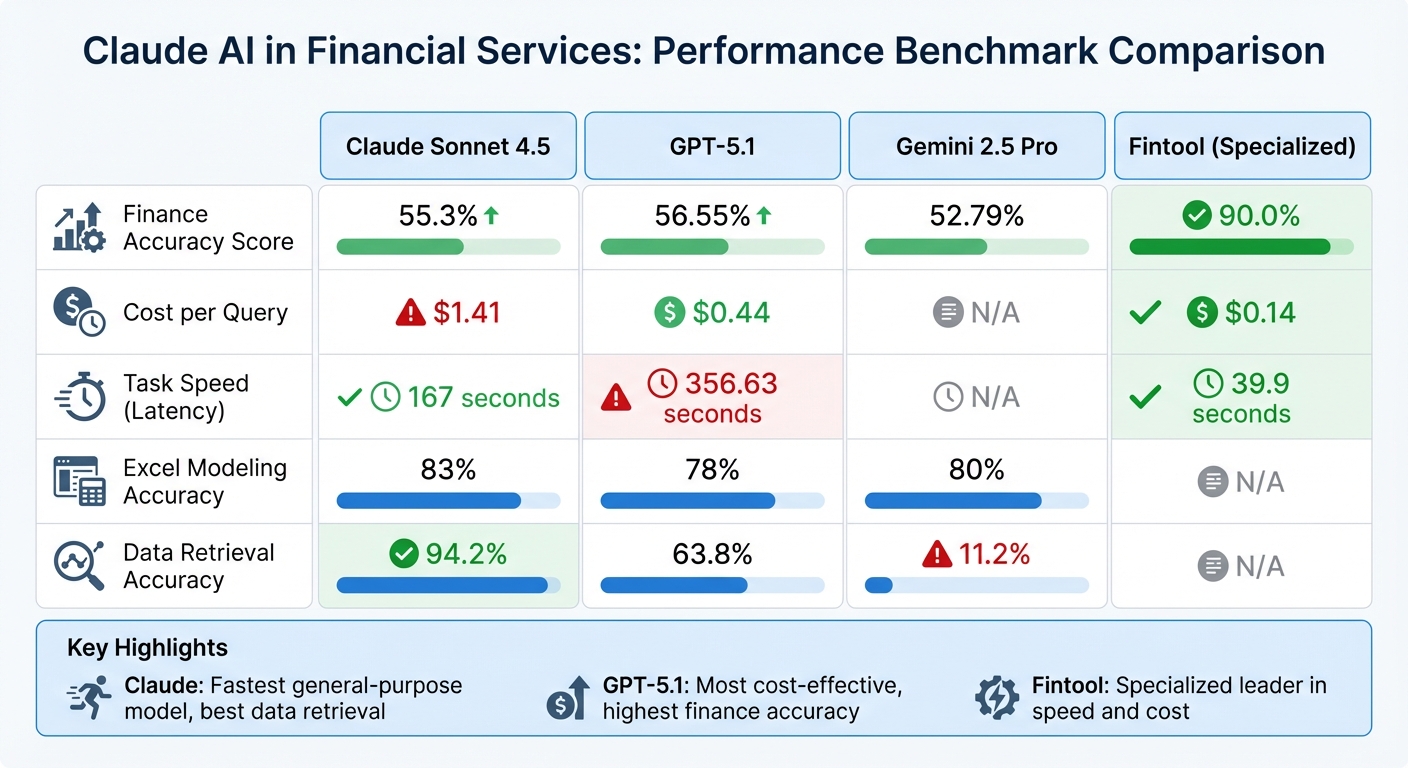

Quick Comparison:

| Model | Finance Accuracy | Cost per Query | Task Speed | Excel Modeling Accuracy | Data Retrieval Accuracy |

|---|---|---|---|---|---|

| Claude Sonnet 4.5 | 55.3% | $1.41 | 167 seconds | 83% | 94.2% |

| GPT-5.1 | 56.55% | $0.44 | 356.63 sec | 78% | 63.8% |

| Gemini 2.5 Pro | 52.79% | N/A | N/A | 80% | 11.2% |

| Fintool (Specialized) | 90.0% | $0.14 | 39.9 sec | N/A | N/A |

Claude stands out for its integration capabilities, financial reasoning, and workflow productivity, making it a strong choice for finance professionals despite some trade-offs in cost and consistency.

Claude AI vs GPT-5.1 vs Gemini 2.5 Pro Financial Performance Comparison

The AI Upgrade Financial Analysts NEED: Claude for Excel, Live Data & Agent Skills

sbb-itb-f73ecc6

Financial Reasoning Task Results

In the December 2025 Vals AI Finance Agent benchmark – which evaluates SEC filing analysis, quantitative data extraction, and investment insight synthesis – Claude Sonnet 4.5 (Thinking) scored 55.32% accuracy, slightly behind GPT 5.1’s 56.55%. Claude Opus 4.5 (Thinking) followed closely at 55.23%, while GPT 5.2 and OpenAI o3 scored 52.79% and 47.69%, respectively.

Claude’s performance stands out due to its extensive use of tools, averaging 12.1 interactions per task and employing functions like edgar_search, parse_html_page, and retrieve_information. However, this automation comes at a cost: GPT 5.1 sessions cost $0.44 compared to Claude’s $0.98. On the flip side, Claude is significantly faster, completing tasks in 140.86 seconds, while GPT 5.1 takes 356.63 seconds. These differences highlight the trade-offs when comparing these systems in practical applications.

In head-to-head real-world matchups, GPT-5 emerged victorious 59% of the time against Claude, though Claude maintained a 52% win rate over Gemini 2.5 Pro. Claude also excelled in Excel-based financial modeling tasks. For example, Claude Opus 4 successfully passed 5 out of 7 levels in the Financial Modeling World Cup, achieving 83% accuracy on complex spreadsheet challenges.

However, notable weaknesses were observed in regulatory risk assessments. In Basel capital optimization tasks, Claude Sonnet 4.5 incorrectly applied the Internal-model MAR21 framework instead of the Standardized MAR22 framework, resulting in flawed capital calculations. Additionally, it struggled with maintaining consistency over multi-step tasks, often corrupting formulas and omitting data in extended financial projections.

"Overall, GPT would confuse financial analysts more than it would help them with this document." – Carla, Finance and Operations Manager

Claude’s performance improves significantly when paired with specialized tools. Using the Daloopa Model Context Protocol, it achieved an impressive 94.2% exact-match accuracy on grounded financial retrieval tasks. This far outperformed ungrounded GPT-5, which scored 63.8%, and Gemini 2.5 Pro, which lagged behind at 11.2%.

Workflow Integration and Productivity

Claude’s ability to boost productivity comes from how effortlessly it integrates with existing financial systems. Take the example of Norges Bank Investment Management (NBIM). In July 2025, they connected Claude to their Snowflake data warehouse, enabling portfolio managers to query data and track news on 9,000 companies. According to CEO Nicolai Tangen, this move resulted in a 20% productivity boost – saving a staggering 213,000 hours of manual work. This success highlights Claude’s compatibility with diverse systems and its potential to enhance operations across financial ecosystems.

What sets Claude apart is its open approach to connectivity. Unlike BloombergGPT, which is locked into its proprietary data, or Microsoft Copilot, which operates solely within the Microsoft 365 environment, Claude links up with multiple licensed data providers. For instance, it uses MCP connectors to access financial data from LSEG, credit research from Moody’s, and Capital IQ financials from S&P Global. This cross-platform compatibility empowers analysts to pull live data directly into Excel, making their workflows more dynamic and efficient.

Claude’s Excel integration takes things further. It functions as a robust add-in that can debug formulas, maintain dependencies, and log changes for compliance purposes. AIG tested this feature in 2025, embedding Claude into its underwriting processes. CEO Peter Zaffino shared that this reduced review times by more than fivefold and improved data accuracy from 75% to over 90%.

On top of these integrations, Claude’s "Agent Skills" feature simplifies complex financial tasks. These pre-designed workflows handle essential processes like DCF modeling, WACC calculations, comparable analyses, and due diligence. By using these tools, companies can cut integration times by three to six months. While Microsoft Copilot focuses on general productivity, Claude shines in regulated financial environments, offering specialized reasoning and detailed audit trails tailored to the industry’s needs.

Pros and Cons

Claude has made impressive strides in financial services benchmarks. For instance, it achieved 55.3% accuracy on the Finance Agent benchmark, surpassing GPT-5’s 46.9%, particularly in tasks involving integrated tool use and information retrieval. Another highlight is the token efficiency of Claude Opus 4.1, which reached 81.51% accuracy using just 139,373 tokens, compared to Gemini 2.5 Pro’s 711,359 tokens for similar results. Additionally, Claude Opus 4.5 demonstrated strong resistance to prompt injection attacks, with a 4.7% success rate against such attacks, outperforming both Gemini 3 Pro (12.5%) and GPT-5.1 (21.9%). The table below provides a detailed comparison of key metrics.

Comparison Table

| Model | Finance Agent Score | Excel Accuracy | Cost per Query | Latency |

|---|---|---|---|---|

| Claude Sonnet 4.5 | 55.3% | 83% | $1.41 | 167 s |

| GPT-5 | 46.9% | 78% | $0.78 | 504 s |

| Gemini 2.5 Pro | N/A (Failed tasks) | 80% | N/A | N/A |

| Fintool (Specialized) | 90.0% | N/A | $0.14 | 39.9 s |

However, Claude does have its limitations. In multi-step workflows, coherence issues can arise. For example, during Excel tasks, it has been known to corrupt formulas or omit data in extended projections. Regulatory tasks have also exposed flaws; Claude Sonnet 4.5 once misapplied Basel capital calculations, leading to inflated requirements. Cost and speed are additional concerns. At $1.41 per query with a latency of 167 seconds, Claude is pricier and slower than OpenAI’s o3, which costs $0.13 per query and delivers results in 45 seconds, though it remains faster than GPT-5’s 504 seconds.

When it comes to head-to-head matchups, GPT-5 won 59% of the time. However, Claude consistently outperformed Gemini 2.5 Pro, which struggled with tasks like processing uploaded workbooks or generating required files. Specialized models, such as Fintool, continue to dominate narrow use cases, achieving 90% accuracy while operating 25 times faster and at 183 times less cost than human analysts.

Despite these challenges, Claude has seen a 78% adoption rate in financial services, thanks to its practical mix of features. Organizations value its transparent change logs, cross-platform connectivity via MCP connectors, and pre-built Agent Skills for tasks like discounted cash flow modeling and due diligence. The productivity boost is evident – Norwegian Bank Investment Management (NBIM), for instance, saved 213,000 hours by using Claude. These factors play a crucial role as financial institutions weigh performance, cost, and integration needs when choosing AI solutions.

Conclusion

Claude AI has proven itself as a standout model in financial services, showcasing strengths in workflow integration and abstract reasoning. On the Finance Agent benchmark, Claude Sonnet 4.5 was only slightly behind GPT 5.1 by just over 1 percentage point, while Claude Opus 4.5 outperformed GPT 5.1 by more than double on the ARC-AGI-2 reasoning benchmark.

Beyond benchmarks, Claude shines with its integration capabilities. Features like its Excel add-in and MCP connectors allow for real-time data verification and streamlined workflow automation. Bobby Grubert, Head of AI and Digital Innovation at RBC Capital Markets, emphasized this advantage:

"Claude excels by seamlessly integrating multiple data sources and automating workflows that previously consumed significant time".

Specialized tools such as Fintool achieve 90% accuracy with faster speeds and lower costs, while GPT 5.1 offers slightly better raw benchmark accuracy and a lower per-query cost.

When comparing Claude 3.5 Sonnet and GPT-4o, Claude stands out for its Excel integration, strong abstract reasoning, and enhanced security, with a vulnerability rate of just 4.7% (a key focus of Claude 3.5 Sonnet for Enterprise) compared to GPT 5.1’s 21.9%. On the other hand, GPT 5.1 is a better choice for those prioritizing raw accuracy and cost efficiency. However, human oversight remains critical, as even the best models achieve less than 60% accuracy on complex financial tasks.

Claude’s impact is evident in practical applications. For instance, its deployment helped NBIM save 213,000 hours and reduced AIG review timelines by a factor of five, while improving accuracy from 75% to over 90%. Additionally, when paired with grounded data sources, Claude can boost exact-match accuracy from 30% to over 94%. These results highlight the real-world value of integrating advanced AI models like Claude into financial workflows.

FAQs

How does Claude AI enhance efficiency in financial services workflows?

Claude AI enhances productivity in financial services by providing tools that simplify complex tasks and minimize manual work. For instance, its Excel add-in can analyze, debug, and edit formulas while also auto-filling templates with a clear record of changes.

On top of that, it offers pre-built connectors and agent skills to handle tasks like data retrieval, financial modeling, compliance checks, and risk assessment automatically.

By optimizing these processes, Claude AI helps improve accuracy, speed up decision-making, and frees up professionals to concentrate on more strategic responsibilities.

What makes Claude AI’s integration features valuable for financial services?

Claude AI integrates effortlessly with widely-used tools in the financial services sector, helping teams streamline their workflows. A standout feature is the Claude for Excel add-in, which lets users analyze, update, and create spreadsheets directly in Excel. It preserves formula dependencies and provides clear explanations for every modification. This makes complex tasks like debugging models, filling out templates, or conducting scenario analyses quicker and more manageable.

Beyond Excel, Claude connects seamlessly with live market data feeds, portfolio analytics platforms, and enterprise data warehouses such as Databricks and Snowflake. This integration ensures users have real-time access to financial data while enabling instant source verification. By automating repetitive tasks, logging actions for full transparency, and delivering consistent performance, Claude allows analysts to concentrate on uncovering deeper insights – all within the tools they already know and trust.

What are the challenges Claude AI faces in handling regulatory tasks in finance?

Claude AI has demonstrated promise in various financial workflows, but it faces clear limitations when it comes to tasks that demand strict precision, especially in regulatory contexts. Take the Finance Agent benchmark as an example: this test involves tasks like extracting metrics from SEC filings and verifying the accuracy of financial statements. While a specialized tool scored an impressive 90% accuracy, Claude lagged behind at just 55.3%. This gap underscores the model’s struggles to meet the rigorous accuracy levels required for regulatory compliance.

Regulatory tasks are particularly unforgiving because they often deal with dense, legally binding disclosures. Even a small error in these areas can lead to significant compliance risks. Although Claude offers user-friendly features like real-time data connectors and Excel integrations, these enhancements alone aren’t enough. To truly excel in regulatory tasks, the model needs to improve its factual accuracy, develop more robust verification processes, and align more closely with strict compliance standards.