Claude is transforming financial risk management by helping businesses and investors analyze risks faster, more accurately, and at scale. It processes large datasets, runs simulations, and integrates with platforms like Snowflake and S&P Global to deliver actionable insights. Major firms like AIG and Norges Bank Investment Management have already seen results: AIG cut business review times by 5x and improved data accuracy from 75% to over 90%, while NBIM saved 213,000 hours annually through automation. Claude’s tools include scenario analysis, portfolio optimization, and pattern recognition, making it a powerful ally in navigating today’s complex financial landscape.

Key highlights:

- Real-time data analysis: Automates tasks like stress testing and risk modeling.

- Improved efficiency: Reduces manual work and accelerates decision-making.

- Integration-ready: Works with systems like Bloomberg, FactSet, and Morningstar.

- Proven impact: Boosts productivity and accuracy for leading financial institutions.

For businesses, Claude offers flexible deployment options (cloud, hybrid, or on-premise) and custom modeling capabilities, making it a versatile tool for managing risks in an ever-changing market.

How AI Is Helping To Take The Risk Out Of Risk Management

Claude‘s Core Capabilities for Financial Risk Assessment

Claude 3 AI Chat reshapes financial risk assessment by focusing on three main areas: scenario simulation, portfolio optimization, and pattern recognition. Together, these tools streamline traditionally manual processes, delivering real-time analytics that adjust to market changes as they occur.

Scenario Analysis and Stress Testing

Claude simplifies complex financial modeling through Monte Carlo simulations and stress tests that previously took weeks to complete. By automating multi-sheet scenario analysis in Excel and integrating with platforms like Bloomberg, FactSet, and S&P Global, Claude provides real-time data for tasks like constructing volatility surfaces and calculating Value at Risk (VaR).

One standout feature is Claude’s ability to generate synthetic datasets when historical data is limited, enabling the simulation of hypothetical scenarios. This approach has led to a 30% improvement in prediction accuracy for financial institutions using AI, with 74% of those employing synthetic data reporting enhanced predictive models.

Aaron Linsky, CTO of AIA Labs at Bridgewater Associates, highlighted Claude’s impact in July 2025:

"Claude powered the first versions of our Investment Analyst Assistant, which streamlined our analysts’ workflow by generating Python code, creating data visualizations, and iterating through complex financial analysis tasks with the precision of a junior analyst."

With its 200,000-token processing window, Claude can analyze massive documents – like S-1 filings and multi-year financial statements – quickly identifying cross-document risks. This capability allows analysts to efficiently model the effects of macroeconomic shocks on entire portfolios without manually connecting disparate data points.

These advanced simulation features lay the groundwork for the portfolio optimization techniques that follow.

Portfolio Optimization and Risk Reduction

Building on its simulation capabilities, Claude enhances portfolio performance through precise optimization techniques. Using Hidden Markov Models, Claude identifies market conditions – bull, bear, or stagnant – and adjusts strategies to maximize returns or limit risks as needed.

Claude also constructs alpha factors from SEC filings and news to fine-tune long-short portfolios. Additionally, it incorporates liquidity risk metrics to account for market impact during rebalancing. Impressively, Claude Opus 4 achieved 83% accuracy on complex Excel tasks and successfully passed 5 out of 7 levels of the Financial Modeling World Cup.

| Optimization Technique | Market Condition | Primary Objective |

|---|---|---|

| Maximum Expected Return | Bull Market | Maximize gains within leverage constraints |

| Minimum Variance (CVaR) | Bear Market | Protect against downside risk and mitigate tail risks |

| Maximum Sharpe Ratio | Stagnant Market | Enhance risk-adjusted returns using mean reversion |

For effective implementation, connecting Claude to real-time data ensures that optimization strategies remain aligned with current market conditions. Using the "Extended Thinking" mode for complex multi-position analysis improves the quality of workbooks by generating functional formulas and cross-sheet references.

Market and Behavioral Pattern Recognition

Claude’s pattern recognition capabilities add another layer of insight by identifying market anomalies. By analyzing raw financial data, Claude uncovers shifts in market share, changes in competitive positioning, and behavioral irregularities among peer groups. It also flags operational risks like customer concentration issues, declining margins, and deviations from historical performance.

For example, CBA’s deployment of Claude led to a 30% reduction in fraud incidents, a 50% decrease in scam-related losses, and a 40% drop in call center volume. Rodrigo Castillo, CBA’s Chief Technology Officer, commented:

"Claude’s advanced capabilities… are central to our purpose of harnessing AI responsibly, as we drive for transformation in critical areas like fraud prevention & customer service enhancement."

Claude also excels in monitoring global newsflow and earnings calls. NBIM, for instance, uses Claude to track news for 9,000 companies, enabling their risk department to query Snowflake data warehouses and analyze earnings calls.

To fully leverage these pattern recognition tools, analysts can connect Claude to internal data warehouses like Snowflake or Databricks. Setting up prompts to flag lagging portfolio components or identify companies with declining margins relative to their 5-year averages makes anomaly detection more efficient. Claude addresses the "trust problem" in finance by providing direct links to source materials, allowing analysts to verify identified patterns instantly.

Data Integration and Analysis

Claude is reshaping financial risk management by seamlessly combining data from various sources through its "Retrieve-Analyze-Create" workflow. It pulls in real-time market feeds, internal data repositories like Snowflake and Databricks, and document management platforms such as Box. By transforming raw inputs into actionable insights through pattern recognition, Claude eliminates the hassle of juggling multiple disconnected systems. This unified framework also lays the groundwork for the specialized connectors and in-depth analyses discussed later.

The Model Context Protocol (MCP) enables Claude to tap into specialized financial data providers. These include FactSet for equity prices, S&P Global for earnings transcripts, PitchBook for private market intelligence, Daloopa for operational KPIs from SEC filings, and Morningstar for economic moat ratings. These connections ensure smooth data integration, which is crucial for precise financial risk assessments.

With the expanded context window in the Claude 4 model family, the system can analyze hundreds of documents simultaneously. To minimize errors and "hallucinations", Claude includes direct links to original sources, allowing analysts to verify claims during risk assessments. For instance, in July 2025, under CEO Peter Zaffino, AIG incorporated Claude into its underwriting process. This integration cut the business review timeline by over five times while boosting data accuracy from 75% to more than 90%.

Using Alternative Data Sources

Claude goes beyond traditional data by integrating alternative sources like news feeds and social media sentiment to detect early market signals. Through MCP connectors, it combines unstructured data with structured market information, creating detailed risk profiles. Its sentiment engines can process thousands of articles per minute, offering company-specific insights and broader sector analyses. For example, the system can differentiate between bullish signals for individual stocks and bearish trends affecting entire industries.

In June 2025, a real-time intelligence platform powered by Claude analyzed a 3.2% daily drop in NVDA stock. It calculated a news sentiment score of -0.42, linking the decline to headlines about China’s chip restrictions and identifying institutional repositioning through trading volume spikes. The platform ultimately recommended a "HOLD" position with a stop-loss set at $137.50. Additionally, Claude identifies correlation risks by tracking how assets behave during market disruptions. To handle alternative data efficiently, financial teams can implement multi-level caching strategies, such as using L1 in-memory and L2 in Redis, ensuring rapid access to risk metrics. Analysts can also organize their work into distinct Claude "Projects", uploading source materials like 10-K reports and investor presentations to maintain a persistent knowledge base across sessions.

Beyond individual asset analysis, Claude also addresses larger economic challenges.

Macroeconomic and Geopolitical Risk Analysis

Claude’s "Macro Analyst" agents specialize in tracking economic indicators, central bank policies, and shifts in market regimes to uncover broader risks. These agents monitor legislative sessions and Federal Register documents to evaluate regulatory changes and their implications. On the geopolitical front, Claude automates the analysis of news and earnings transcripts to identify supply chain vulnerabilities in regions such as China and Taiwan.

Claude also conducts scenario-based stress testing to simulate the effects of macroeconomic events, including stagflation reminiscent of the 1970s, Japan-like deflation, or financial crises akin to 2008. It examines geopolitical developments, regulatory shifts, and central bank statements – such as Federal Reserve commentary – to predict impacts on Treasury yields and currency values. To enhance the accuracy of these high-stakes analyses, analysts are encouraged to use "mitigant prompts" that challenge assumptions, incorporate differing viewpoints, and rank facts by their relevance rather than recency.

sbb-itb-f73ecc6

Implementation and Business Integration

Getting Claude up and running for financial risk operations involves securing the right licenses and setting up the necessary technical infrastructure. To begin, organizations must obtain a Claude for Financial Services license through Anthropic Sales or the AWS Marketplace, alongside licenses for data providers like S&P Global or Daloopa. Cloud deployment costs approximately $40 per user each month (with a 25-user minimum), while initial implementation support is priced at about $15,000, plus $5,000 for training.

MCP connectors play a critical role in linking Claude to key financial data sources such as FactSet, Morningstar, S&P Global, and internal systems like Snowflake and Databricks. Among financial institutions, 87% prefer cloud deployment due to its speed and security features. Cloud setup is quick – taking just 15 minutes – while hybrid deployment requires 2–4 weeks, and on-premise installations may take 6–8 weeks.

To streamline adoption, Anthropic offers a specialized six-week program tailored for financial services. This package includes training, technical setup for MCP servers, and guidance on best practices. For organizations with complex regulatory requirements, partnerships with firms like PwC (for compliance) or Deloitte (for equity research) provide additional support.

Below, we explore deployment options, custom modeling capabilities, and the advantages of multi-model access for financial risk analysis.

Enterprise Deployment Methods

Financial institutions can choose from three deployment strategies, each balancing speed, security, and control differently. Cloud deployment is the fastest option, with setup completed in about 15 minutes. It features automatic updates and minimal IT involvement, making it ideal for firms confident in Anthropic’s security protocols. Importantly, data processed through Claude for Enterprise is not used to train generative models, ensuring intellectual property remains secure.

Hybrid deployment works well for organizations that need to keep sensitive data on-premises while still leveraging cloud-based inference. This setup typically takes 2–4 weeks and requires collaboration between internal IT teams and Anthropic’s support staff. For the highest level of security, on-premise deployment ensures complete data isolation, though implementation requires 6–8 weeks. This option is best suited for firms with stringent regulatory demands or highly sensitive data.

Regardless of the deployment model, security is a top priority. For example, sensitive resources like API credentials should remain outside Claude’s environment, with a proxy used to inject keys into requests. Multi-tenant environments benefit from hardened Docker containers with configurations like --cap-drop ALL, --read-only, and --network none to reduce vulnerabilities. Legacy systems such as COBOL mainframes or AS/400 platforms can be integrated using Node.js bridges, MQ Series message queues, or REST API wrappers for real-time queries.

| Deployment Model | Implementation Time | Monthly Cost Per User | Best For |

|---|---|---|---|

| Cloud | 15 minutes | ~$40 | Quick setup, automatic updates |

| Hybrid | 2–4 weeks | Custom pricing | Balances security with cloud benefits |

| On-Premise | 6–8 weeks | Custom pricing | Maximum security and data isolation |

Once deployed, Claude’s flexibility allows seamless integration into existing financial systems, tailored to meet specific business needs.

Custom Financial Modeling with Claude

Claude’s deployment options empower organizations to enhance portfolio management and decision-making through advanced risk analysis.

Beyond pre-built templates, Claude enables custom risk model development. Using the Claude Developer Platform, businesses can embed its capabilities into proprietary trading systems, risk management tools, or KYC workflows. With Claude Code, analysts can modernize outdated trading systems, design unique risk models, and automate complex tasks like Monte Carlo simulations.

The "Projects" feature is central to custom modeling. Teams can upload proprietary templates, historical data, and industry benchmarks to create a persistent knowledge base. Claude then generates models that adhere to internal formatting standards. For intricate multi-position analyses, the "Extended Thinking" feature helps produce detailed workbooks with functional formulas.

At Bridgewater, AIA Labs has used Claude to develop an Investment Analyst Assistant since 2023. Aaron Linsky, CTO of AIA Labs, shared:

"Claude powered the first versions of our Investment Analyst Assistant, which streamlined our analysts’ workflow by generating Python code, creating data visualizations, and iterating through complex financial analysis tasks with the precision of a junior analyst." – Aaron Linsky, CTO, AIA Labs at Bridgewater

In beta, Claude for Excel offers cell-level citations for calculations and traces errors to their source without breaking dependencies. Some firms report that 75% of engineers save 8 to 10+ hours weekly by using Claude-powered agents for SQL queries. Integration with MCP connectors ensures real-time updates for comparable company multiples, keeping risk benchmarks aligned with shifting market conditions.

For example, in January 2026, Claude was used to evaluate MediTech Solutions. It pulled historical financials from Daloopa, healthcare SaaS comparables from S&P Global, and customer concentration benchmarks from the web to create a three-scenario Excel model (Bear, Base, Bull) with IRR sensitivity tables. This process, which typically takes 4–6 hours manually, was completed in under 30 minutes.

Using Fello AI for Multi-Model Access

Financial professionals often rely on multiple AI models to validate risk assessments and minimize bias. Fello AI (https://claude3.pro) provides a unified platform that integrates Claude with other leading models like GPT-5.1, Gemini, Grok, and DeepSeek, accessible on Mac, iPhone, and iPad. Instead of juggling multiple subscriptions and apps, users can test the same risk scenario across various AI systems within a single interface.

This approach is particularly useful for high-stakes financial decisions. For instance, you could ask Claude to analyze a portfolio’s exposure to geopolitical risks and then cross-check the results with GPT-5.1 and Gemini. If all models identify similar vulnerabilities, it strengthens confidence in the findings. Discrepancies, on the other hand, may highlight areas requiring further investigation.

Fello AI is also practical for routine tasks like drafting investment memos, brainstorming hedging strategies, or researching regulatory updates. Its ability to switch models mid-conversation allows users to leverage Claude’s strength in financial modeling while using other models for tasks like summarizing earnings calls. For teams seeking flexibility without the hassle of managing multiple AI tools, Fello AI simplifies the process with its all-in-one design.

Results and Case Studies

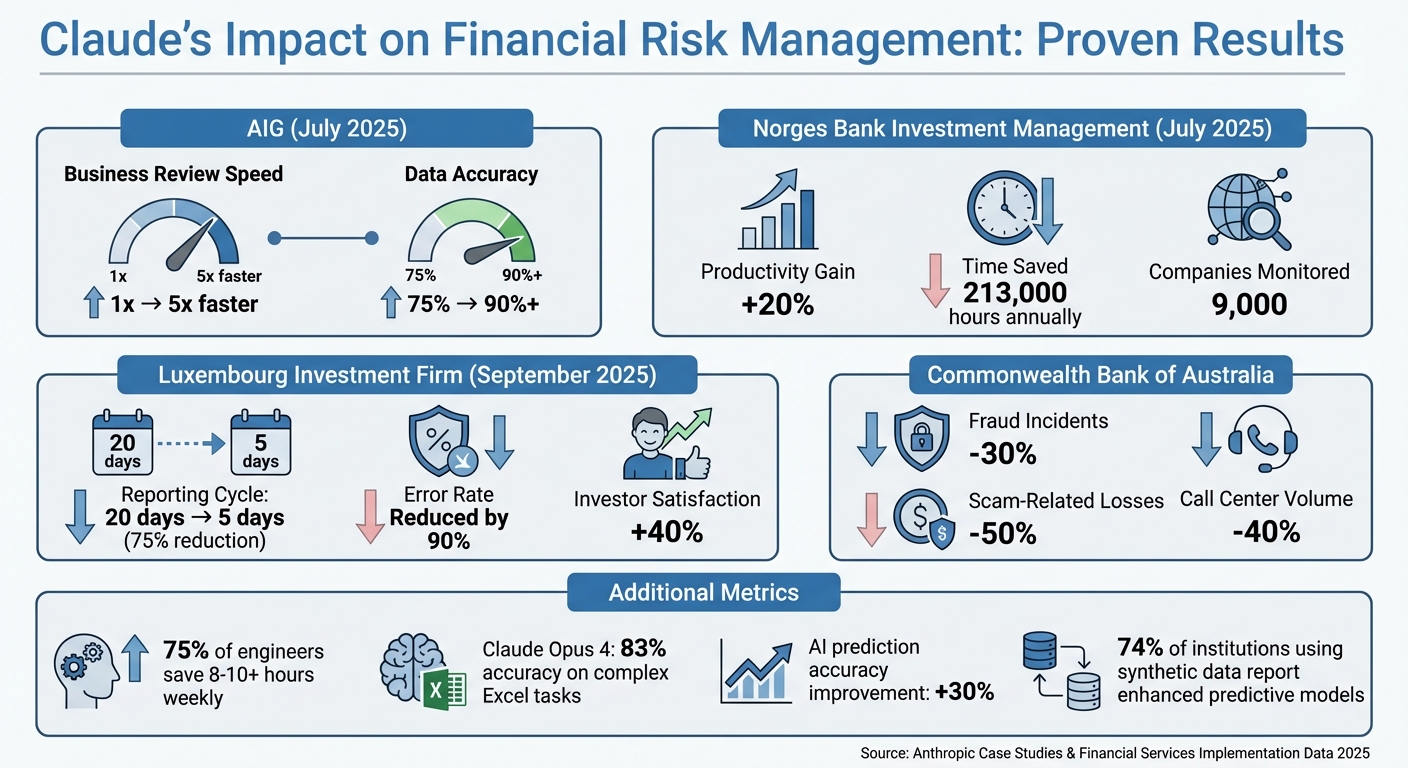

Claude Financial Risk Management Impact: Key Performance Metrics Across Major Institutions

Claude’s advanced analytics have reshaped risk management, delivering measurable improvements in speed, accuracy, and overall efficiency. The following case studies highlight its impact across various financial institutions.

Faster Risk Assessment Workflows

In July 2025, AIG achieved a remarkable transformation by reducing its business review timeline by over five times while increasing data accuracy from 75% to above 90%. Similarly, Norges Bank Investment Management (NBIM), the largest sovereign wealth fund globally, reported a 20% boost in productivity – equivalent to saving 213,000 hours – by automating newsflow monitoring for 9,000 companies and optimizing data queries from their Snowflake data warehouse.

In another example, a Luxembourg-based investment firm drastically cut its reporting cycle from 20 days to just 5 days in September 2025. This change also reduced error rates by 90% and improved investor satisfaction by 40%.

Improved Portfolio Performance

Claude’s precise analytical capabilities extend beyond streamlining workflows – it also enhances portfolio outcomes. For instance, Bridgewater Associates implemented an Investment Analyst Assistant powered by Claude in 2023. According to CTO Aaron Linsky, the tool significantly improved analyst workflows by generating Python code and creating data visualizations, enabling the execution of complex financial tasks with the precision of a junior analyst.

Private equity firms using Claude through Chronograph‘s integration have uncovered critical insights within their portfolio data, such as identifying material risks like customer concentration.

| Institution | Metric | Before Claude | After Claude | Timeframe |

|---|---|---|---|---|

| AIG | Review Speed | Baseline (1x) | 5x Faster | July 2025 |

| AIG | Data Accuracy | 75% | 90%+ | July 2025 |

| NBIM | Productivity Gain | Baseline | +20% (213,000 hrs) | July 2025 |

| Luxembourg Firm | Reporting Cycle | 20 Days | 5 Days | Sept 2025 |

| Luxembourg Firm | Error Rate | Baseline (100%) | 10% of Baseline | Sept 2025 |

These case studies clearly demonstrate how Claude enhances both operational efficiency and accuracy, making it an invaluable tool for risk management across diverse financial institutions.

The Future of Financial Risk Management with Claude

Claude is reshaping financial risk management by turning reactive strategies into proactive, real-time oversight. This transformation is already happening. For instance, Norges Bank Investment Management now continuously monitors data from 9,000 companies instead of relying on quarterly reviews. This approach allows for swift responses to emerging risks.

One standout feature of Claude is its "Agent Skills." These capabilities enable the platform to autonomously create discounted cash flow models, perform earnings analyses, and compile due diligence data packs. These automated workflows build on Claude’s established track record of success. Bobby Grubert, Head of AI and Digital Innovation at Capital Markets, highlighted this in a recent statement:

"Claude excels by seamlessly integrating multiple data sources and automating workflows that previously consumed significant time. We’re collaborating with Anthropic to digitize workflows across our Capital Markets platform, ensuring our teams can dedicate more time to strategic thinking."

Claude’s efficiency is further amplified by its integration with the Model Context Protocol, connecting it to live market data from sources like LSEG, Moody’s, and S&P Global. This enables dynamic, up-to-the-minute risk assessments. Additionally, the Claude for Excel add-in enhances functionality by reading, editing, and debugging complex spreadsheets while maintaining formula dependencies. These tools are no longer exclusive to large institutions; they’re becoming accessible to a broader range of market participants.

For smaller businesses and individual investors, platforms like Fello AI bring Claude’s advanced risk modeling to devices like Mac, iPhone, and iPad. Fello AI even allows users to switch between multiple models – such as Claude, GPT-5.1, Gemini, Grok, and DeepSeek – within a single interface, making powerful risk management tools available to a wider audience.

The shift in risk management is clear: static, team-based analyses are giving way to continuous, AI-driven monitoring. These changes echo earlier productivity breakthroughs, highlighting Claude’s growing influence in this space. With Claude Sonnet 4.5 achieving 55.3% accuracy on the Vals AI Finance Agent benchmark and reports showing that 75% of engineers save 8 to 10+ hours weekly using Claude-powered agents, the efficiency benefits are undeniable.

FAQs

How does Claude enhance data accuracy and speed up financial reviews?

Claude ensures data accuracy by pulling information directly from trusted financial data sources like SEC filings, Morningstar, and S&P Global feeds. By doing this, it eliminates common manual errors, such as re-typing or copy-pasting, and links figures directly to their original sources for easy verification. On top of that, Claude cross-checks data, flags any inconsistencies, and highlights important metrics, providing a reliable starting point for analysis.

When it comes to financial reviews, Claude speeds up the process significantly. It automates everything – from importing data to generating insights and drafting reports. Claude calculates key ratios, prepares reports, and even tracks changes in tools like Excel, making it easy for users to verify results and finalize decisions. This automation cuts review times from days to just minutes, saving businesses both time and effort.

What are the options for integrating Claude into financial systems?

Claude offers several ways to integrate its tools into financial workflows as part of the Claude for Financial Services suite. These options are designed to streamline processes and improve efficiency:

- Enterprise Cloud (SaaS): Gain API-level access to Claude’s advanced language features. This is perfect for tasks such as modernizing trading systems or automating compliance workflows.

- Developer SDK: Embed Claude into custom tools and applications. For instance, you can use it to enhance risk models or power Monte Carlo simulations.

- Excel Add-In: Currently in beta, this feature lets analysts work with Claude directly in Microsoft Excel. Use it to query data, generate spreadsheets, or track changes seamlessly.

Claude also comes with pre-built connectors for key financial data sources like Morningstar, S&P Global, and internal platforms such as Snowflake. These connectors integrate easily with existing systems and can be accessed through APIs, the Enterprise console, or the Excel add-in, ensuring compatibility with your workflows.

How does Claude use alternative data to improve financial risk analysis?

Claude improves financial risk analysis by combining traditional data with alternative sources to reveal risks that might otherwise go unnoticed. It taps into tools like market feeds, cloud-based data platforms, and third-party systems to collect insights from areas such as transaction patterns, supply chain dynamics, and private company performance. This approach goes far beyond standard financial reports like balance sheets or price feeds.

By bringing these datasets together, Claude gives analysts a unified platform where every piece of information is traceable back to its original source for easy validation. It also keeps risk dashboards updated in real time, allowing businesses and individuals to spot potential issues – like liquidity challenges or supply chain bottlenecks – before they escalate. With this, users can adjust their strategies based on the most current and thorough data available.